How UK Firms Can Master Self Assessment Deadlines?

Managing Self Assessment deadlines in the UK is one of the biggest annual challenges for accounting firms. With strict HMRC deadlines, high client expectations, and the risk of costly penalties, even small inefficiencies can quickly turn the busy season into a stressful one.

For UK accounting firms, success during Self Assessment season depends on proactive planning, efficient workflow management, clear client communication, and the right technology. Firms that adopt structured processes and practice management tools are better equipped to meet tax return deadlines, reduce errors, and improve overall productivity.

In this guide, we explore proven strategies UK accounting firms can use to handle Self Assessment deadlines effectively, avoid HMRC penalties, and streamline their accounting workflow—while delivering a better experience for both staff and clients.

Proactive Planning and Preparation

The key to successfully navigating Self Assessment deadlines is proactive planning. Follow these essential steps:

Early Engagement

Engage with clients well in advance, ideally in spring or summer. This allows ample time to gather information and resolve potential issues before the 31 January online filing deadline.

Client Segmentation

Categorize clients based on complexity, industry, and past data. This helps allocate resources efficiently and tailor your approach to each client’s needs.

Deadline Awareness

Clearly communicate all relevant deadlines, including the paper filing deadline (31 October). Remind clients about HMRC penalties for late submissions. HMRC Self Assessment Overview

Resource Allocation & Staff Training

Assess your team’s capacity, consider temporary staff during peak periods, and ensure everyone is trained on Self Assessment regulations and workflow procedures.

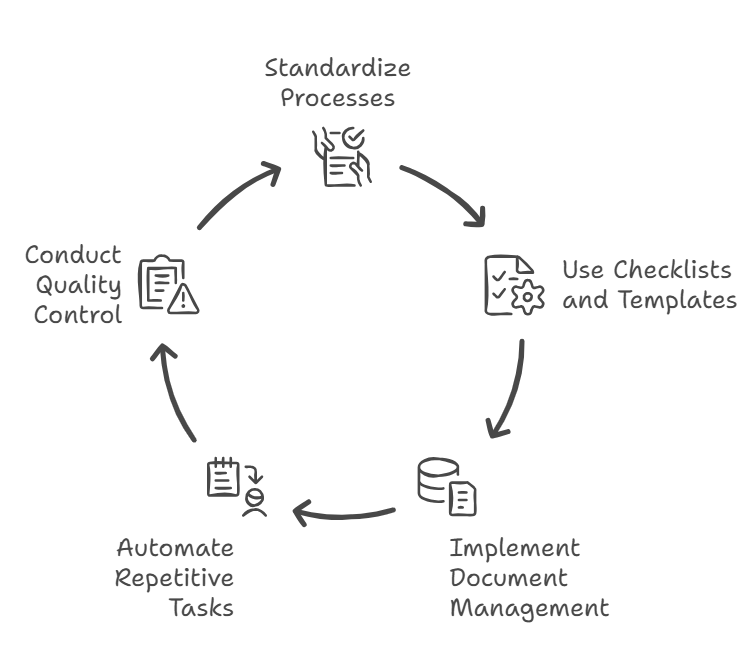

Efficient Workflow Management

Streamlining workflow is critical for efficiency and accuracy. Consider the following:

- Standardized Processes: Standardizing processes ensures consistency across all Self Assessment cases, regardless of complexity. By using defined procedures for data collection, tax return preparation, and review, accounting firms reduce errors, improve turnaround times, and make it easier to onboard new staff during peak season.

- Checklists & Templates: Digital checklists and templates are now a best practice among UK firms. They guide staff through every stage of the Self Assessment process, ensuring no step is missed—from client onboarding to final HMRC submission. This approach supports compliance, improves accountability, and aligns well with remote or hybrid teams.

- Document Management: With HMRC’s growing focus on data security and audit trails, secure document management systems are no longer optional. Cloud-based document storage allows firms to organize client records, control access, and retrieve information quickly—while remaining compliant with UK data protection standards.

- Workflow Automation: Workflow automation is a major trend in UK accounting practices. Automating repetitive tasks such as reminders, task assignments, and status updates frees up time for higher-value advisory work. Automation also helps firms handle higher workloads during Self Assessment season without increasing staff costs.

- Quality Control: Implementing structured quality control processes—such as peer reviews or automated validation checks—helps minimize errors and reduce the risk of HMRC penalties. Many firms now use automated checks to flag missing data or inconsistencies before submission, improving accuracy and client confidence.

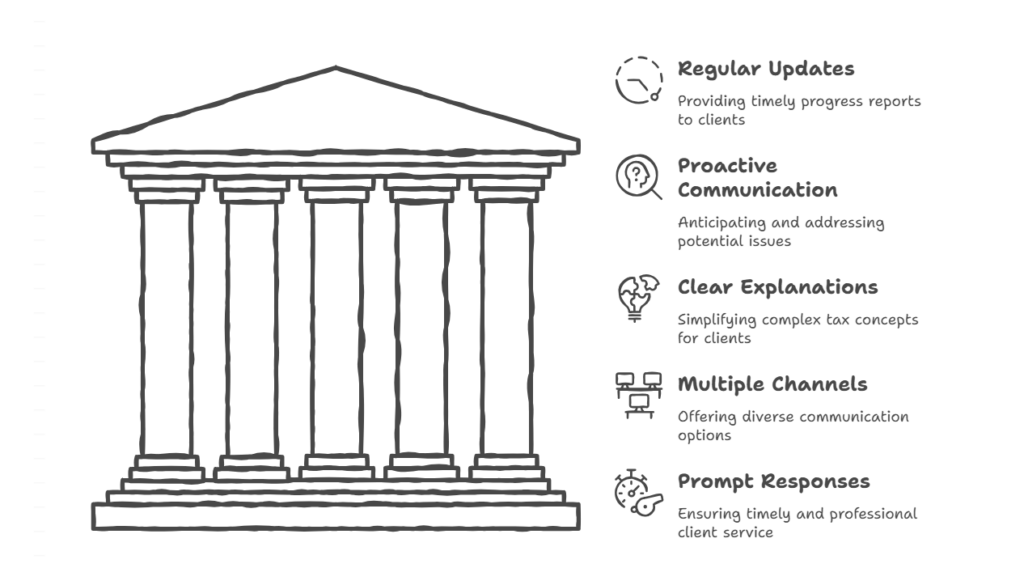

Effective Client Communication

Maintaining clear communication builds trust and prevents delays:

- Regular Updates: Keeping clients informed about progress and outstanding documents reduces last-minute stress. Automated status updates or reminders ensure clients know exactly what is required and when—helping firms meet Self Assessment deadlines UK more consistently.

- Proactive Communication: Proactively addressing potential issues—such as missing records or complex income sources—prevents escalation close to deadlines. Firms that anticipate problems early are better positioned to manage workload spikes and avoid rushed submissions.

- Clear Explanations: Clients value simple, jargon-free explanations of tax obligations. Clear communication builds trust and positions your firm as a reliable advisor, not just a compliance provider.

- Multiple Channels: Modern clients expect flexibility. Offering communication via email, phone, and secure client portals allows firms to meet clients where they are while keeping sensitive data protected.

- Prompt Responses: Fast response times signal professionalism and reliability. Accounting firms that respond promptly strengthen long-term client relationships and improve retention—especially during the high-pressure Self Assessment period.

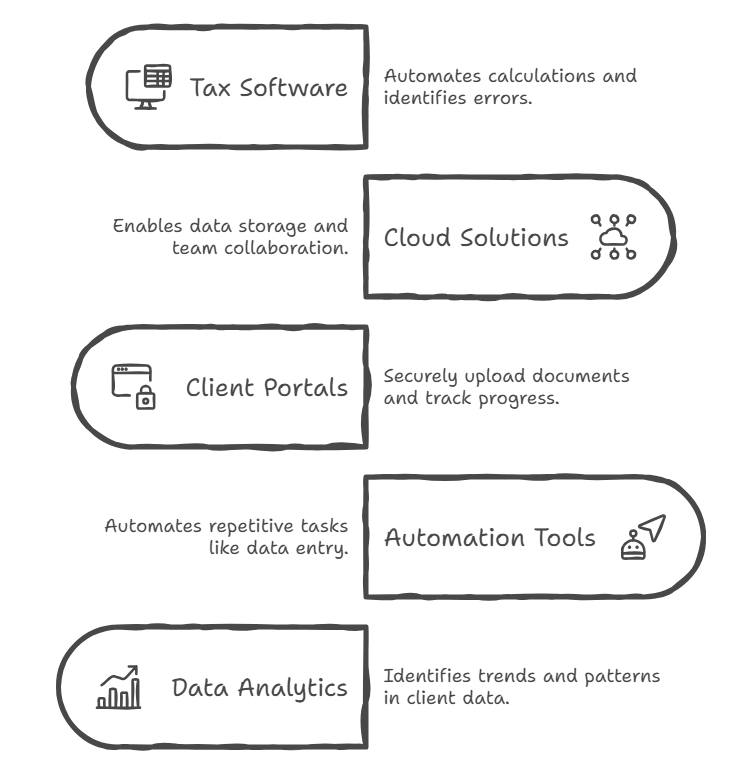

Leveraging Technology

Technology can significantly improve efficiency and reduce errors:

- Tax Preparation Software: Modern tax preparation software automates calculations, validates data, and supports electronic filing with HMRC. This reduces manual effort and ensures compliance with current regulations.

- Cloud-Based Solutions: Cloud-based accounting and practice management platforms enable collaboration across teams and locations. They support remote work, real-time updates, and centralized data—key advantages during peak Self Assessment periods.

- Client Portals: Secure client portals are increasingly expected by UK clients. They allow clients to upload documents, track progress, and communicate securely, reducing email back-and-forth and improving efficiency.

- Automation Tools: Automation tools help firms eliminate repetitive administrative tasks such as chasing documents or assigning work. This not only saves time but also improves staff morale and reduces burnout during busy seasons.

- Data Analytics: Advanced analytics tools allow firms to identify trends, forecast workloads, and uncover tax planning opportunities. Data-driven insights help firms move beyond compliance into higher-value advisory services.

Post-Deadline Analysis

After deadlines pass, review and improve processes:

- Review Metrics: Analyzing key metrics such as the number of returns filed, average preparation time, and error rates provides valuable insights into operational performance.

- Identify Improvements: Identifying bottlenecks—whether in client onboarding, document collection, or review stages—allows firms to streamline workflows and improve efficiency for the next cycle.

- Gather Feedback: Feedback from staff and clients highlights pain points and opportunities for improvement. Many firms now run short post-season surveys to capture actionable insights.

- Implement Changes & Plan Ahead: SImplementing improvements early and planning well in advance of the next Self Assessment deadlines UK helps firms reduce stress, improve compliance, and deliver a better client experience year after year.

Streamline Your Practice with Technology

Effectively managing Self Assessment deadlines is crucial for UK accounting firms to stay compliant, reduce stress, and keep clients satisfied. By implementing proactive planning, efficient workflows, clear client communication, and leveraging the right technology, your firm can navigate the busy season with confidence and efficiency.

At Sliq360, we provide a Practice Management Software designed specifically for accountants. Our platform helps your team centralize tasks, track deadlines, and automate repetitive processes—ensuring faster turnaround times, fewer errors, and a smoother Self Assessment season for both your staff and clients.

Take control of your Self Assessment workflow and see how a practice management system can transform the way your firm works.

Book a demo of Sliq360 today and experience a more organized, stress-free accounting season.